- CEOCap

- Jaime Watt’s Debut Bestseller ‘What I Wish I Said’

- Media Training

- The Push Back

- Internship program

- Update Your Profile

- Homepage

- It’s time for a change

- It’s time for a change

- Kio

- Ottawa

- Art at Navigator

- Navigator Limited Ontario Accessibility Policy

- Virtual Retreat 2020 Closing Remarks

- COVID-19 Resources

- Offices

- Navigator Sight: COVID-19 Monitor

- Navigator Sight: COVID-19 Monitor – Archive

- Privacy Policy

- Research Privacy Policy

- Canadian Centre for the Purpose of the Corporation

- Chairman’s desk

- ELXN44

- Media

- Perspectives

- Podcasts

- Subscribe

- Crisis

- Reputation

- Government relations

- Public affairs campaigns

- Capital markets

- Discover

- true

- How we win

- What we believe

- Who we are

- Careers

- Newsroom

- AI

- Empower by Navigator

- Environmental responsibility

Toronto is a serious contender as cities vie to replace London as a global financial hub

MONEY IS A SKITTISH SORT OF THING. For all the elaborate stone structures built to contain it, for all the clever, pin-striped advisers and regulators who prudently plan its future, money always has its bag packed and one foot out the door. At the first whiff of uncertainty, it bolts.

It comes as no surprise, then, that a vote in favour of “Brexit”— and the United Kingdom’s messy departure from the European Union—has made money especially jumpy, compromising London’s long-standing role as a global financial centre.

The Bank of England has asked U.K. banks, insurers and other financial institutions to draw up comprehensive strategies for dealing with Brexit, and it will scrutinize them closely. But as it was with the handover of Hong Kong to China in 1997, no amount of public reassurance or display of contingency planning is capable of forestalling the inevitable.

As a result, pundits have been predicting which European city will provide the requisite reassurance that attracts money, and, however briefly, holds it. Will it be Paris, Amsterdam, Frankfurt or Luxembourg?

Canadian banks—all of them have significant presence in London—are already softly repositioning themselves for change. The level of engagement ranges from a staff of 20 for National Bank to more than 5,000 for RBC. TD Bank recently announced plans to expand its presence in Dublin, while RBC has already trimmed back its investment banking ranks ostensibly to reflect diminished deal flow. They’ve all admitted at various times that they have a close eye on their operations there.

WHEN MONEY IS ON THE MOVE, IT CREATES NEW OPPORTUNITIES.

In the face of such upheaval, there is only one certainty: When money is on the move, it creates new opportunities. Among the international cities well-positioned to benefit from a shift away from London is Toronto.

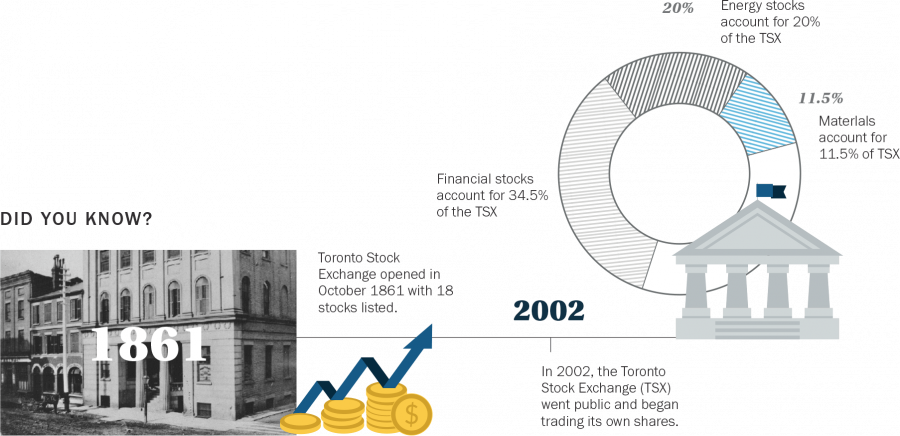

Think about it. The world’s largest banks already have footholds in Toronto. The city’s financial sector has a deep bench of educated workers with expertise in both traditional banking and fintech. The Toronto Stock Exchange is already the eighth largest in the world, with market capitalization of around $2.5 trillion—significantly larger than Frankfurt’s DAX.

The city is consistently ranked one of the top places in which to live. In August, The Economist magazine’s annual survey cities placed Toronto fourth of 140 international cities reviewed. Toronto boasts good schools, cultural activities galore, top sports teams and urban infrastructure. It even has an easily accessible downtown airport that provides connection to New York City and Washington, D.C.

Although English is the dominant language—considered a plus in financial markets—Toronto is exceptionally multicultural. This is a draw for firms that must relocate top talent and for understanding the subtle nuance of dealing with other international markets.

Furthermore, Canada is a leader in the standards for and enforcement of financial regulations, something for which it received accolades during the 2008 global financial crisis. Our legal system is based on British jurisprudence. The political system is stable and transparent. We stand for law, order and good government.

It’s true that London has been a point of commercial intersection since Roman times, but Toronto is also exceptionally well-placed to attract nervous money and talent from another financial hub under siege—New York.

U.S. President Donald Trump is openly preparing to put his political imprint on management of the U.S. Federal Reserve (Janet Yellin’s term as chair of the board of governors expires in February 2017) and a Republican-controlled Congress has begun the push for greater deregulation and an easing of capital requirements for big banks, just a decade after the last global financial crisis.

That’s not the only concern of nervous money: Much of the post-election stock market surge in the U.S. was predicated on Trump pushing through tax reform and infrastructure spending, both of which look increasingly unlikely. Even the prospect of political failure is likely to send money scuttling for cover at the same time as the impact of Brexit becomes clearer.

In fact, it’s a safe bet it’s already called a cab to the airport.